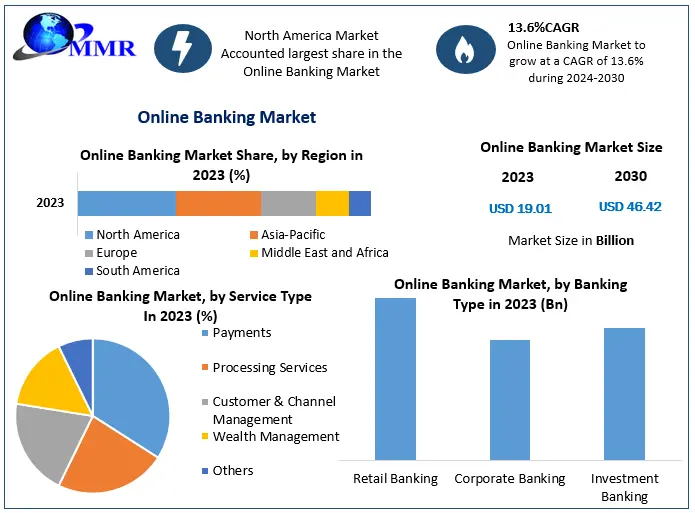

Online Banking Market was valued at US$ 19.01 Bn. in 2023 and is expected to reach US$ 46.42 Bn. by 2030, at a CAGR of 13.6% during a forecast period.

What is Online Banking Market scope?

The Online Banking Market encompasses the sector of financial services conducted through digital platforms, allowing users to perform a range of banking activities such as account management, transactions, bill payments, and more via the Internet. This market is driven by increasing consumer preference for convenience and accessibility, advancements in technology, and the growing adoption of e-commerce and digital payments. The scope includes various service types, such as payment services, and banking types, notably retail banking, with a focus on enhancing user experience and integrating innovative digital solutions.

Geographically, the Online Banking Market spans regions including North America, Asia Pacific, and Europe, each exhibiting unique growth dynamics influenced by local technological advancements, regulatory environments, and consumer behaviors. The market’s expansion is supported by ongoing digital transformation efforts and government initiatives promoting financial inclusion and digital literacy. Despite challenges like cybersecurity risks, the sector is poised for significant growth, driven by technological progress and evolving customer expectations.

Download a Free PDF Sample of the Report: Full TOC, Tables, Figures & Charts Included@ https://www.maximizemarketresearch.com/request-sample/84177/

Online Banking Market Trends:

The Online Banking Market is experiencing several key trends, including the growing integration of advanced technologies such as artificial intelligence (AI) and blockchain. AI is being used to enhance customer service through chatbots and personalized recommendations, while blockchain is improving security and transaction transparency. Additionally, the rise of mobile banking apps and digital wallets reflects the increasing consumer preference for convenient, on-the-go financial management. These technologies are making online banking more efficient, secure, and user-friendly.

Another notable trend is the increasing emphasis on cybersecurity as online banking becomes a primary target for cyber-attacks. Financial institutions are investing heavily in robust security measures and fraud detection systems to protect user data and maintain trust. Moreover, regulatory bodies are introducing stricter guidelines to ensure data privacy and security. This heightened focus on cybersecurity is shaping the future of online banking by driving innovations that enhance protection and reduce vulnerabilities.

What are Online Banking Market Dynamics?

The dynamics of the Online Banking Market are primarily driven by the demand for convenience and accessibility. Consumers increasingly prefer digital banking solutions that allow them to manage their finances anytime, anywhere, leading to a surge in online banking adoption. Technological advancements, such as the integration of AI for personalized services and blockchain for enhanced security, are further propelling market growth. Additionally, the proliferation of mobile devices and internet connectivity is facilitating greater adoption of online banking services.

Conversely, the market faces challenges such as heightened cybersecurity risks and regulatory pressures. Cyber-attacks on financial institutions are a major concern, prompting banks to invest in sophisticated security measures to protect customer data and maintain trust. Regulatory bodies are also enforcing stricter compliance standards to safeguard digital transactions. These factors contribute to the market dynamics by influencing the pace of adoption and the strategic focus of online banking providers.

Get An Exclusive Sample Of The Online Banking Market Report At This Link (Get The Higher Preference For Corporate Email ID): – https://www.maximizemarketresearch.com/request-sample/84177/

What is the Regional Insights Of Online Banking Market Expected to grow?

The Online Banking Market is expected to experience substantial growth across various regions, with North America leading due to its high technology adoption and advanced IT infrastructure. The region’s strong digital banking ecosystem, characterized by sophisticated online platforms and extensive consumer adoption, positions it as a major contributor to market expansion. Additionally, North America’s focus on enhancing user experience through innovative digital solutions supports its dominant market share.

In Asia Pacific, rapid growth is anticipated due to increasing government initiatives promoting digital financial services, such as the Digital India campaign. This region’s expanding internet connectivity and smartphone penetration are driving the adoption of online banking. Similarly, Europe is seeing significant growth in countries like Germany and the Nordics, where there is a marked shift from physical cash to digital transactions. Each region’s unique technological advancements and regulatory environments are shaping their respective contributions to the global online banking market.

what is the expected growth of Online Banking Market segmentation?

The Online Banking Market is expected to see robust growth across its key segments. In terms of service types, the payment segment is anticipated to continue its dominance due to rising smartphone usage and the increasing preference for digital payment solutions. The shift towards real-time payment capabilities and the convenience of online bill payments are driving this trend, reflecting an ongoing consumer demand for seamless financial transactions.

Regarding banking types, retail banking is projected to maintain its significant share as financial institutions adapt to evolving customer needs with enhanced digital services. The market is expanding due to increased competition and technological innovations aimed at improving customer experience and account management. Both segments are poised for substantial growth, driven by advancements in technology and changing consumer behaviors towards digital financial solutions.

What is Online Banking Market Segmentation?

by Software Type

Customized software

Standard software

by Service Type

Payments

Processing Services

Customer & Channel Management

Wealth Management

Others

by Banking Type

Retail Banking

Corporate Banking

Investment Banking

Do You Have Any Query Or Specific Requirement? Ask to Our Industry Expert @ https://www.maximizemarketresearch.com/market-report/global-online-banking-market/84177/

What are the key Players for Online Banking Market

1.ACI Worldwide, Inc.

2. Capital Banking Solution

3. CGI Inc.

4. COR Financial Solutions Limited

5. EdgeVerve Systems Limited

6. Fiserv, Inc.

7. Microsoft

8. Oracle

9. Tata Consultancy Services Limited

10. Temenos Headquarters SA

11. Financial Network services

12. Corillian

13. I-flex Solutions

14. Canopus Software Laboratory

15. First Source Bank

16. Rockall Technologies.

17. Appway AG

18. CREALOGIX AG

19. ebankIT

20. Etronika

21. Fidor Solutions AG

22. Finastra

23. Halcom.com

24. Infosys Limited

25. Intellect Design Arena Limited

26. SAP SE

27. Sopra Steria

Key Offerings:

- Past Market Size and Competitive Landscape

- Online Banking Market Size, Share, Size & Forecast by different segment

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

- Online Banking Market Segmentation – A detailed analysis by Product

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of business by region

- Lucrative business opportunities with SWOT analysis

- Recommendations

More Trending Reports by Maximize Market Research –

global Hospital Bed Market https://www.maximizemarketresearch.com/market-report/global-hospital-bed-market/65073/

Dill Pickles Market https://www.maximizemarketresearch.com/market-report/global-dill-pickles-market/101387/

Global Elderflower Market https://www.maximizemarketresearch.com/market-report/global-elderflower-market/94093/

Global Trailer Axle Market https://www.maximizemarketresearch.com/market-report/global-trailer-axle-market/83234/

Global Smartphone Display Market https://www.maximizemarketresearch.com/market-report/global-smartphone-display-market/54391/

Global Backup as a Service Market https://www.maximizemarketresearch.com/market-report/global-backup-as-a-service-market/24854/

Organic Almond Market https://www.maximizemarketresearch.com/market-report/global-organic-almond-market/26205/

Fiber laser Market https://www.maximizemarketresearch.com/market-report/fiber-laser-market/13165/

Automotive Suspension System Market https://www.maximizemarketresearch.com/market-report/automotive-suspension-system-market/145858/

India Display Market https://www.maximizemarketresearch.com/market-report/display-market/12063/

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656