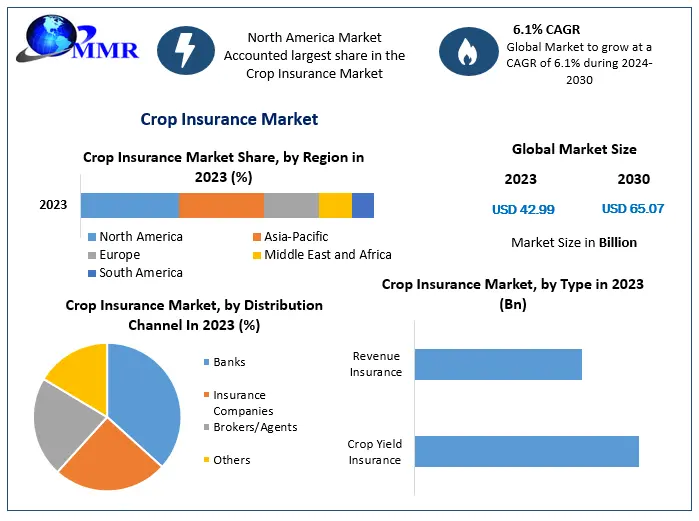

Crop Insurance Market was valued at USD 42.99 Bn in 2023 and is expected to reach USD 65.07 Bn by 2030, at a CAGR of 6.1% during the forecast period.

What is Crop Insurance Market scope?

The global Crop Insurance Market provides a safety net for agricultural producers by protecting them against financial losses due to crop failures or declines in market prices. The market covers various types of insurance policies, including crop-yield insurance and revenue protection, which safeguard farmers from natural disasters such as droughts, floods, and pests. This insurance is crucial in ensuring the sustainability of farming operations and stabilizing the agricultural economy. The market scope includes a wide range of stakeholders, such as farmers, insurance companies, government agencies, and financial institutions, each contributing to the market’s growth and functionality.

Download a Free PDF Sample of the Report: Full TOC, Tables, Figures & Charts Included: https://www.maximizemarketresearch.com/request-sample/148613/

Crop insurance is gaining prominence in both developed and developing nations due to increasing climate risks, volatile market conditions, and government support. In regions like North America, Europe, and Asia-Pacific, the market is expanding rapidly as more farmers opt for insurance to mitigate risks. The market is further driven by technological advancements, such as satellite-based monitoring and data analytics, which help in assessing crop health and yield more accurately. These innovations are expected to broaden the market’s reach and efficiency, offering more tailored solutions to farmers.

Crop Insurance Market Trends:

One of the prominent trends in the crop insurance market is the rising adoption of technology-driven solutions, such as precision farming and satellite imagery, to improve risk assessment and policy pricing. Insurers are leveraging big data, artificial intelligence, and remote sensing technologies to better predict crop yields, monitor field conditions, and assess losses due to natural disasters. This shift toward technology is enhancing the efficiency of insurance processes, reducing fraud, and ensuring quicker claim settlements. Furthermore, mobile and online platforms for purchasing and managing crop insurance policies are gaining popularity, especially in rural areas.

What are Crop Insurance Market Dynamics?

The global crop insurance market is primarily driven by the increasing vulnerability of agriculture to climate change and extreme weather events, which pose a constant risk to crop yields. This rising risk complexity, coupled with the need for financial security in agriculture, is propelling the demand for crop insurance. Additionally, the growing awareness among farmers about the benefits of crop insurance, supported by government initiatives, is contributing to market expansion. The introduction of innovative insurance products, such as index-based insurance and revenue protection policies, is providing farmers with more diverse options to safeguard their investments.

Get An Exclusive Sample Of The Crop Insurance Market Report At This Link (Get The Higher Preference For Corporate Email ID): https://www.maximizemarketresearch.com/request-sample/148613/

How is the Asia-Pacific Crop Insurance Market Expected to grow?

The need for crop insurance has increased exponentially as a result of the Asia-Pacific region’s fast industrialization and population growth. The crop insurance market is anticipated to develop at a compound annual growth rate (CAHR) of 29% over the course of the forecast period in Asia-Pacific, which offers enormous growth prospects. China and India are the two most significant crop insurance-producing nations in Asia Pacific. Large tracts of agricultural land and ideal weather conditions are expected to fuel the expansion of the crop insurance market in Asia Pacific over the forecast period.

What is the expected growth of Crop Insurance Market by Coverage Type segmentation?

The worldwide crop insurance market is divided into two segments based on the kind of coverage: crop-hail insurance and multi-peril crop insurance (MPCI). Private crop insurance firms and brokers provide services for the government-sponsored and regulated MPCI crop insurance program. When buying crop insurance, almost 78% of farmers select MPCI. The value of the crop affects both the cost of insurance and the amount paid out by an insurer in the case of a loss. Though not all crops are available in every region, MPCI is available for over 120 crops.

What is Crop Insurance Market Segmentation?

by Coverage Type

Multi-peril Crop Insurance (MPCI)

Crop-hail Insurance

by Distribution Channel

Banks

Insurance Companies

Brokers/Agents

Others

by Type

Crop Yield Insurance

Revenue Insurance

Do You Have Any Query Or Specific Requirement? Ask to Our Industry Expert @ https://www.maximizemarketresearch.com/market-report/crop-insurance-market/148613/

What are the key Players for Crop Insurance Market?

North America

1. American Finlands Group Inc

2. American International Group Inc

3. AmTrust Financial Services Inc

4. VANE (Insurance)

5. Duck Creek Technologies

Europe

6. axa insurance

7. Chubb Ltd

8. groupama assurances mutuelles

9. Zurich Insurance Co. Ltd

10. The Co-operators

APAC

11. Agriculture Insurance Co. of India Ltd.

12. ICICI Bank Ltd.

13. Indian Farmers Fertiliser Cooperative Ltd. (IFFCO)

14. QBE Insurance Group Ltd

15. Sompo Holdings In

Key Offerings:

- Past Market Size and Competitive Landscape

- Crop Insurance Market Size, Share, Size & Forecast by different segment

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

- Crop Insurance Market Segmentation – A detailed analysis by Product

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of business by region

- Lucrative business opportunities with SWOT analysis

- Recommendations

More Trending Reports by Maximize Market Research –

Household Appliances Market https://www.maximizemarketresearch.com/market-report/household-appliances-market/194211/

Portable Air Conditioner Market https://www.maximizemarketresearch.com/market-report/portable-air-conditioner-market/194526/

Equestrian Apparel Market https://www.maximizemarketresearch.com/market-report/equestrian-apparel-market/194597/

Wine Corks Market https://www.maximizemarketresearch.com/market-report/wine-corks-market/194610/

Drainage System Market https://www.maximizemarketresearch.com/market-report/drainage-system-market/194322/

Gamepad Market https://www.maximizemarketresearch.com/market-report/gamepad-market/200169/

Non-Invasive Blood Glucose Monitoring Devices Market https://www.maximizemarketresearch.com/market-report/non-invasive-blood-glucose-monitoring-devices-market/200549/

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656