Projected Revenue Growth:

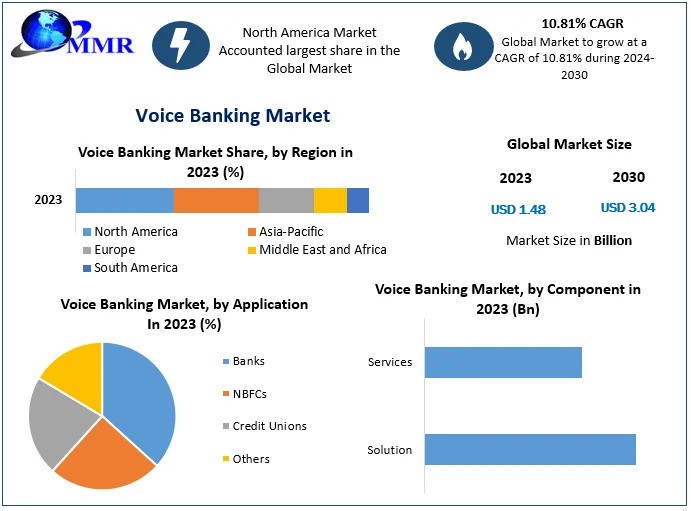

The Voice Banking Market was valued at USD 1.48 Billion in 2024 globally and is expected to reach USD 3.04 Billion by 2030, exhibiting a CAGR of 10.81 % during the forecast period (2024-2030)

What is Voice Banking Market scope?

The Voice Banking market encompasses the integration of AI-based voice technology in financial services, enabling customers to perform various banking operations using voice commands. The scope includes its application in retail and corporate banking, mobile banking, and personal financial management. Key areas of growth within this market are the deployment of voice assistants to enhance customer experience, streamline internal processes, and increase security with voice biometrics. With increasing demand for more efficient and accessible banking services, voice banking is anticipated to expand globally, benefiting from advancements in natural language processing and voice recognition technologies.

This market is driven by the growing need for frictionless, contactless banking solutions, especially in the post-pandemic landscape. It is expected to see significant growth across regions such as North America and the Asia-Pacific (APAC), where banking institutions are focusing on integrating voice solutions into their digital offerings. The report highlights the market’s potential for customization, with detailed insights into voice banking’s types, applications, and growth potential segmented by region, driving technological and service advancements in the sector.

Download a Free PDF Sample of the Report: Full TOC, Tables, Figures & Charts Included @ https://www.maximizemarketresearch.com/request-sample/169729/

Voice Banking Market Trends:

The increasing integration of artificial intelligence and natural language processing (NLP) in voice banking is one of the most significant trends. Banks are leveraging this technology to provide personalized customer experiences, making it easier for clients to manage their finances using voice commands. The use of voice assistants like Alexa, Siri, and Google Assistant in banking services is also growing, with applications ranging from checking account balances to transferring funds. This trend highlights the shift toward more intuitive and user-friendly banking experiences, driven by customer demand for seamless, 24/7 services.

Additionally, voice banking is gaining traction for its enhanced security measures, particularly through voice biometrics. This biometric verification process adds an extra layer of protection by authenticating users based on their unique voice patterns. As voice technology evolves, banks are increasingly adopting these methods to reduce fraud and enhance customer trust. This trend is expected to reshape the banking sector, leading to more widespread use of voice authentication across various financial platforms.

What are Voice Banking Market Dynamics?

Voice banking market dynamics are shaped by various factors, including technological advancements and growing consumer demand for convenience in financial services. The rise of artificial intelligence, particularly in natural language processing and voice recognition, is driving the adoption of voice banking. These technologies enable banks to provide more personalized, efficient, and secure services, allowing customers to interact with their bank accounts through voice commands. Additionally, the increasing use of smart devices such as smartphones and voice-activated home assistants is boosting the demand for voice banking solutions.

However, the market also faces challenges, such as concerns over privacy and data security. As voice banking involves the collection of sensitive personal data, ensuring robust security measures and compliance with regulatory requirements is crucial for market players. Moreover, the initial costs of implementing voice technology and integrating it with existing banking systems can be a barrier for some financial institutions. Despite these challenges, the voice banking market is expected to grow, driven by the increasing demand for innovative, customer-centric banking solutions.

Get An Exclusive Sample Of The Voice Banking Market Report At This Link (Get The Higher Preference For Corporate Email ID): https://www.maximizemarketresearch.com/request-sample/169729/

How is the North America Voice Banking Market Expected to grow?

The North American voice banking market is expected to experience robust growth due to the increasing adoption of voice-enabled technologies in financial institutions. The region has been a pioneer in embracing AI-based solutions, with banks such as Bank of America and JPMorgan Chase introducing voice assistants like Erica to enhance customer service. The demand for contactless and convenient banking experiences is also driving the growth of this market, with voice banking becoming a preferred solution for many consumers, especially in the wake of the COVID-19 pandemic.

In addition to the widespread use of smart devices, North America’s financial sector is heavily investing in voice recognition technologies to enhance security and reduce fraud. Voice biometrics are becoming a key feature in authentication processes, providing customers with a secure and seamless way to manage their finances. As more consumers adopt smart speakers and voice-activated devices, the voice banking market in North America is expected to continue its upward trajectory, expanding further in the coming years.

What is the expected growth of Voice Banking Market segmentation?

The voice banking market is expected to witness significant growth across various segments, including application, technology, and end-users. In terms of application, the mobile banking segment is projected to lead the market, driven by the widespread use of smartphones and the growing popularity of voice assistants in personal finance management. Voice-enabled banking services for retail and corporate clients are also expected to expand, providing enhanced convenience and efficiency for financial transactions and customer interactions.

Technologically, natural language processing (NLP) and voice recognition are anticipated to dominate the market during the forecast period, allowing for more accurate and intuitive user experiences. Among end-users, banks are expected to hold a substantial share of the market, particularly due to their focus on improving customer service and strengthening security with voice biometrics. Additionally, fintech companies and startups are likely to play a vital role in the voice banking ecosystem by introducing innovative solutions tailored to meet the evolving needs of tech-savvy customers.

What is Voice Banking Market Segmentation?

by Component

Solution

Services

by Deployment Mode

On-Premise

Cloud

by Technology

Large Enterprises

Small and Medium-sized Enterprises

by Application

Banks

NBFCs

Credit Unions

Others

by Technology

Machine Learning

Deep Learning

Natural Language Processing

Others

Do You Have Any Query Or Specific Requirement? Ask to Our Industry Expert @ https://www.maximizemarketresearch.com/market-report/voice-banking-market/169729/

What are the key trends for Voice Banking Market

1. U.S. Bank (US)

2. Citigroup (US)

3. Axis Bank(India)

4. HSBC (UK)

5. NatWest Group (UK)

6. IndusInd Bank (India)

7. BankBuddy (India)

8. Central 1 Credit Union (Canada)

9. ICICI bank (India)

10. United Bank of India (India)

11. DBS Bank (Singapore)

12. Acapela Group. (Belgium)

13. Emirates NBD Bank (UAE)

Key Offerings:

- Past Market Size and Competitive Landscape

- Voice Banking Market Size, Share, Size & Forecast by different segment

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

- Voice Banking Market Segmentation – A detailed analysis by Product

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of business by region

- Lucrative business opportunities with SWOT analysis

- Recommendations

More Trending Reports by Maximize Market Research –

♦ Data Privacy Software Market https://www.maximizemarketresearch.com/market-report/data-privacy-software-market/145730/

♦ Acai Berry Market https://www.maximizemarketresearch.com/market-report/acai-berry-market/83963/

♦ Armor Market https://www.maximizemarketresearch.com/market-report/armor-market/124378/

♦ Product Engineering Services Market https://www.maximizemarketresearch.com/market-report/product-engineering-services-market/122268/

♦ Starch Derivatives Market https://www.maximizemarketresearch.com/market-report/global-starch-derivatives-market/27540/

♦ Catalyst Regeneration Market https://www.maximizemarketresearch.com/market-report/global-catalyst-regeneration-market/27353/

♦ Fragrance diffuser market https://www.maximizemarketresearch.com/market-report/fragrance-diffuser-market/146338/

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com