The Global Business Travel Accident Insurance Market study with 132+ market data Tables, Pie charts & Figures is now released by HTF MI. The research assessment of the Market is designed to analyse futuristic trends, growth factors, industry opinions, and industry-validated market facts to forecast till 2030. The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different segments and applications that can potentially influence the market in the future. The detailed information is based on current trends and historic milestones. Some of the players studied are Allianz Partners, American International Group , The Hartford, Chubb Limited , Assicurazioni Generali , Tokio Marine Holdings , AXA , Zurich Insurance , MetLife, Inc. , Nationwide Mutual Insurance Company.

Download Sample Report PDF of Global Business Travel Accident Insurance Market @ https://www.htfmarketintelligence.com/sample-report/global-business-travel-accident-insurance-market?utm_source=Krati_Cineglit&utm_id=Krati

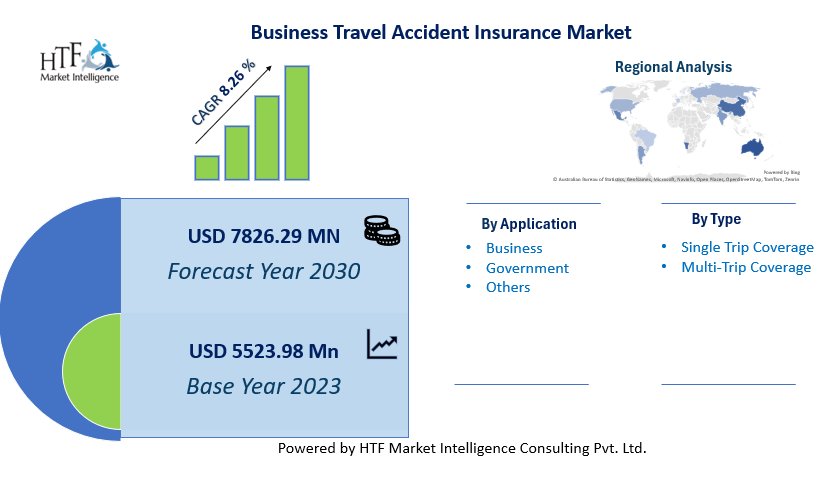

According to HTF Market Intelligence, the global Business Travel Accident Insurance market is valued at USD 5523.98 Million in 2023 and estimated to reach a revenue of USD 7826.29 Million by 2030, with a CAGR of 8.26% from 2023 to 2030.

Definition:

Travel accident insurance is a specialized type of travel insurance plan. It acts as life insurance and it is insurance against accidental death and dismemberment in the case of a travel accident. The benefits are paid regardless of whether the traveler has other AD&D coverage and life insurance. Moreover, some of the insurance plans also cover emergency medical expenses. Limited insurance plans give the maximum reimbursements range to choose from and several are designed specifically for the regular business traveler and include coverage for non-medical emergency evacuations. Business travel can be defined as the traveling performed for the purpose of business between two or more parties. Some of the examples of business travel are traveling from one branch to another branch of the same company, traveling to different locations for meeting any suppliers or business partners, and traveling for a business conference or business event across different locations. Business travel accident insurance is an important benefit for many companies, particularly those with employees who frequently travel internationally on company business.

Market Trends:

Employees Concerns Regarding Business Travel at Present Scenario Pushing the Employers to Adopt Business Travel Insurance

Digitalization and Innovation Across the Insurance Sector

Market Drivers:

Growing Demand for Business Travel

The Rising Worldwide Business Travel Spending

Market Opportunities:

Opportunities Across Emerging Countries

Global Business Travel Accident Insurance Market Competitive Analysis

Know your current market situation! Not just new products but ongoing products are also essential to analyse due to ever-changing market dynamics. The study allows marketers to understand consumer trends and segment analysis where they can face a rapid market share drop. Figure out who really the competition is in the marketplace, get to know market share analysis, market position, % Market Share, and segmented revenue.

Players Included in Research Coverage: Allianz Partners, American International Group , The Hartford, Chubb Limited , Assicurazioni Generali , Tokio Marine Holdings , AXA , Zurich Insurance , MetLife, Inc. , Nationwide Mutual Insurance Company

Additionally, Past Global Business Travel Accident Insurance Market data breakdown, Market Entropy to understand development activity and Patent Analysis*, Competitors Swot Analysis, Product Specifications, and Peer Group Analysis including financial metrics are covered.

Avail Limited Period Offer /Discount on Immediate purchase @ https://www.htfmarketintelligence.com/request-discount/global-business-travel-accident-insurance-market?utm_source=Krati_Cineglit&utm_id=Krati

Segmentation and Targeting

Essential demographic, geographic, psychographic, and behavioural information about business segments in the Business Travel Accident Insurance market is targeted to aid in determining the features the company should encompass in order to fit into the business’s requirements. For the Consumer-based market – the study is also classified with Market Maker information in order to understand better who the clients are, their buying behaviour, and patterns.

Business Travel Accident Insurance Product Types In-Depth: Single Trip Coverage, Multi-Trip Coverage

Business Travel Accident Insurance Major Applications/End users: Business, Government, Others

Business Travel Accident Insurance Major Geographical First Level Segmentation:

• APAC (Japan, China, South Korea, Australia, India, and the Rest of APAC; the Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

• Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

• North America (U.S., Canada, and Mexico)

• South America (Brazil, Chile, Argentina, Rest of South America)

• MEA (Saudi Arabia, UAE, South Africa)

Buy Now Latest Edition of Global Business Travel Accident Insurance Market Report @ https://www.htfmarketintelligence.com/buy-now?format=1&report=35?utm_source=Krati_Cineglit&utm_id=Krati

Research Objectives:

– Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

– To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

– To analyse the with respect to individual future prospects, growth trends and their involvement to the total market.

– To analyse reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

– To deliberately profile the key players and systematically examine their growth strategies.

FIVE FORCES & PESTLE ANALYSIS:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Get Detailed TOC and Overview of Report @ https://www.htfmarketintelligence.com/report/global-business-travel-accident-insurance-market

Thanks for reading this article, you can also make sectional purchase or opt-in for regional report by limiting the scope to only North America, ANZ, Europe or MENA Countries, Eastern Europe or European Union.

About Us:

HTF Market Intelligence is a leading market research company providing end-to-end syndicated and custom market reports, consulting services, and insightful information across the globe. HTF MI integrates History, Trends, and Forecasts to identify the highest value opportunities, cope with the most critical business challenges and transform the businesses. Analysts at HTF MI focuses on comprehending the unique needs of each client to deliver insights that are most suited to his particular requirements.

Contact Us:

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

Connect with us at LinkedIn | Facebook | Twitter